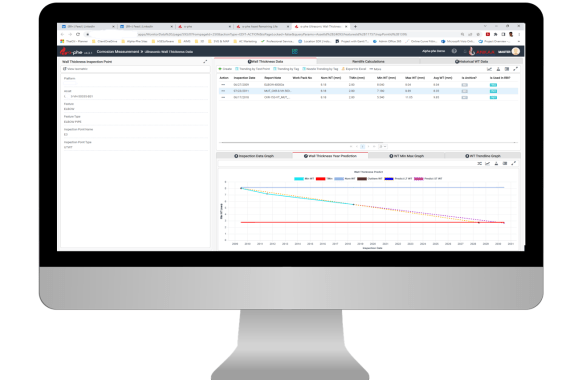

α-phe AIMS – Wall Thickness Measurements

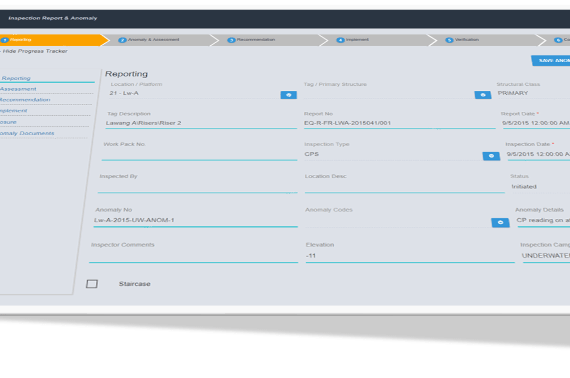

α-phe AIMS (Asset Integrity Management System) is a software system used for managing and maintaining the integrity of assets, such as pressure vessels, piping’s, pipelines, tanks, and other equipment. A key feature of α-phe AIMS is the ability to record and manage data related to the condition of assets, including wall thickness measurements. Ultrasonic wall…